Your Business Deserves Accurate Premiums

We make it happen! We correct errors, recover overpayments, and lower costs—so you only pay what’s fair. No risk, just results.

How We Help

Our expertise spans across key areas of premium cost recovery and risk reduction:

Audit & Review

- Error Identification - We uncover payroll miscalculations, incorrect classifications, and reporting mistakes.

- Premium Validation - Ensuring you’re charged the right amount based on accurate records.

- Compliance & Risk Mitigation - Keeping your premiums aligned with regulatory standards

- Why It Matters - Payroll miscalculations and classification errors can inflate your premiums, leading to thousands in avoidable costs.

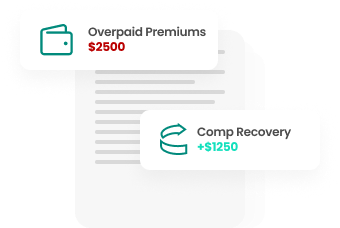

Premium Recovery

- Reclaim Overpaid Premiums - We identify past overcharges and work to recover your money.

- Dispute Resolutions - Handling negotiations directly with insurers to secure corrections

- Historical Analysis - Reviewing previous policy terms for recoverable discrepancies.

- Why It Matters - Many businesses unknowingly overpay for years before realizing mistakes. We ensure you get back what’s yours

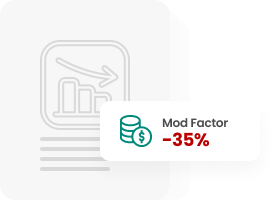

Experience Mod Factor Optimization

- Lower Your Mod Score - We analyze and correct misreported claims that impact your rates.

- Long-Term Cost Reduction - Reducing your mod lowers premiums for years to come.

- Strategic Claims Management - Helping you implement best practices for better future scores.

- Why It Matters - A single miscalculated claim can keep your mod artificially high, costing you significantly in premium hikes

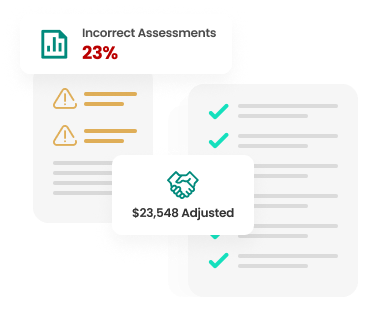

Dispute Resolution

- Challenging Incorrect Assessments - We fight to fix inaccuracies before they increase costs.

- Expert Negotiation - Leveraging our industry experience to advocate for fair adjustments.

- Data-Backed Appeals - Using factual reporting to correct premium-impacting errors.

- Why It Matters - Disputes, when handled properly, can prevent unnecessary premium hikes and resolve costly issues efficiently.

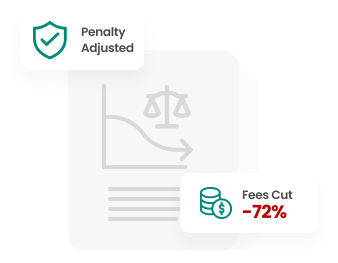

Penalty Reductions

- Unjust Fees Reversed - Addressing misapplied penalties to reduce excessive charges.

- Regulatory Compliance Adjustments - Ensuring audits reflect correct classifications

- WC Board Negotiations - Reducing penalties for lapsed or missing workers' comp insurance.

- Why It Matters - Unfair penalties can drive up costs. We step in to protect your business.

Why Choose Comp Recover?

Proven Success

We've helped businesses recover millions in overpaid premiums.

No-Risk Engagement

We only get paid when we save you money—no upfront costs, no surprises.

End-to-End Support

From audits & negotiations to ongoing monitoring we handle it all.